Select the Statement Below That Describes a Post-closing Trial Balance.

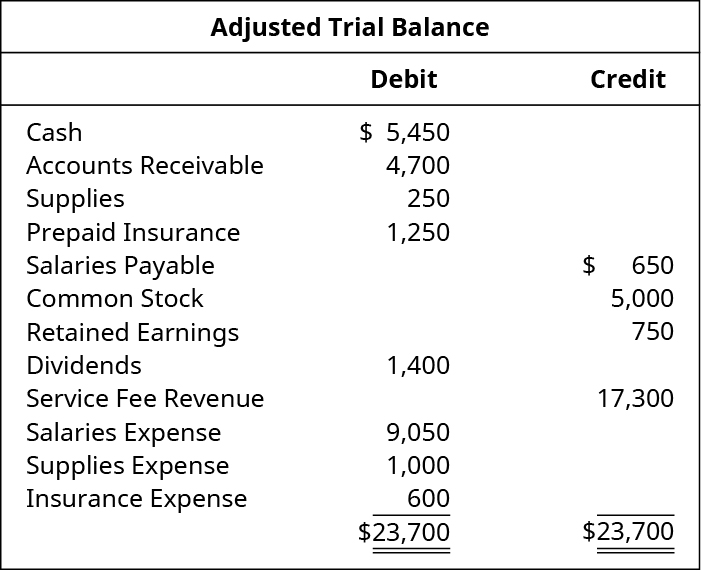

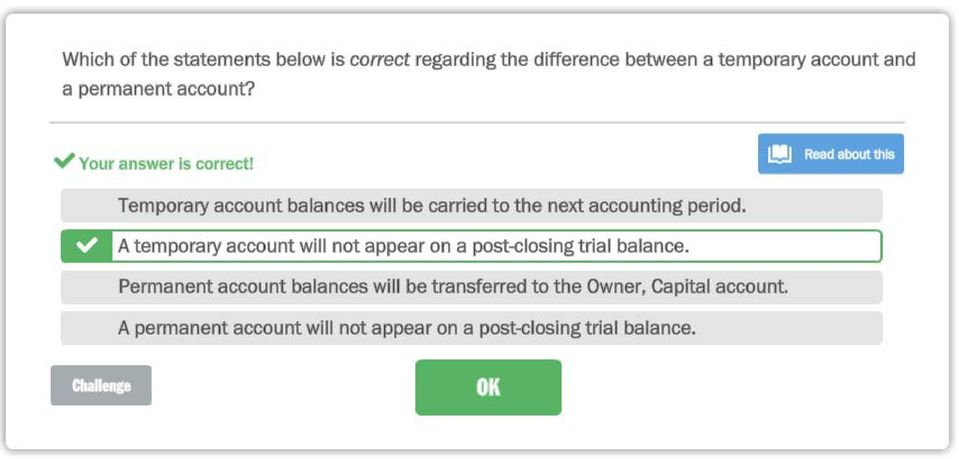

As closing entries close all the temporary ledger accounts the trial. The post-closing trial balance contains no revenue expense gain loss or summary account.

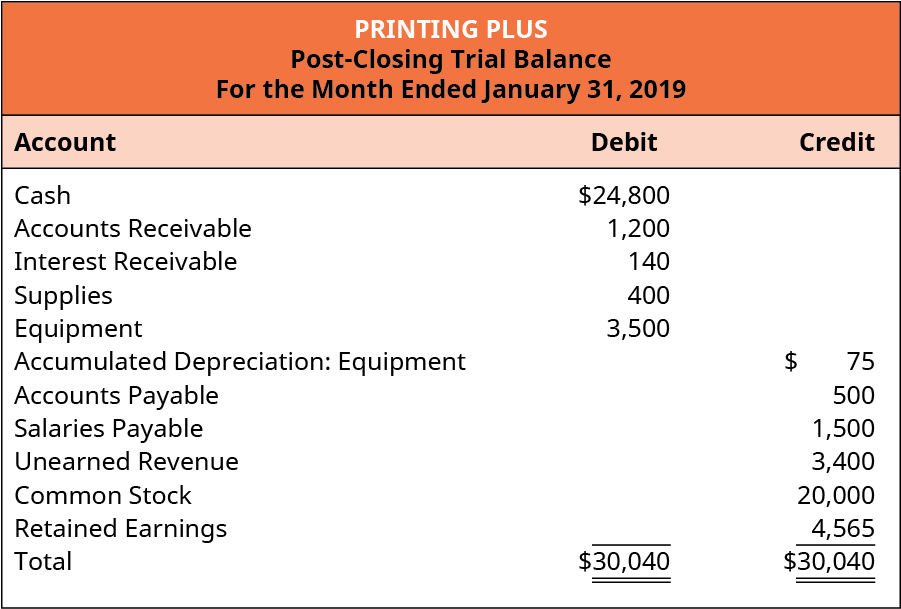

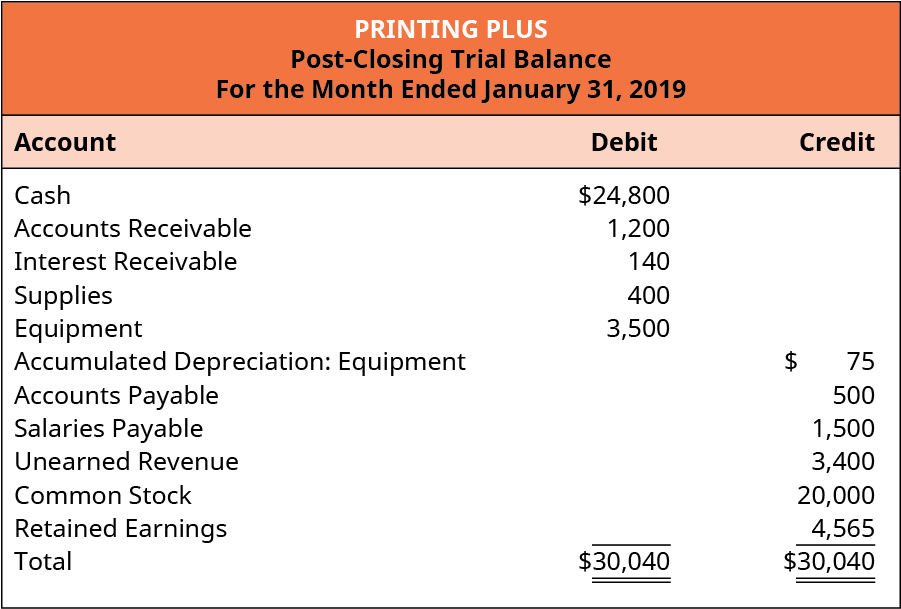

Prepare A Post Closing Trial Balance Principles Of Accounting Volume 1 Financial Accounting

The post-closing trial balance ensures there are no temporary accounts remaining open and all debit balance is equal to all credit balances.

. A post-closing trial balance is a listing of all balance sheet accounts containing non-zero balances at the end of a reporting period. A post-closing trial balance is the final trial balance prepared before the new accounting period begins. You are preparing a trial balance after the closing entries are complete.

The ninth and typically final step of the process is to prepare a post-closing trial balance. Since temporary accounts are already closed at this point the post-closing trial balance will not include income expense and withdrawal accounts. Like all trial balances the post-closing trial balance has the job of verifying that the debit and credit totals are equal.

It shows the balances of permanent accounts balance sheet items at the closing of the reporting period. Used to make sure that beginning balances are correct the post-closing trial balance is. The post closing trial balance is A.

A post-closing trial balance is one of three trial balances. Rashid Javed Updated on. The post closing balance sheet allows a company to balance its accounts by.

Helps compare debits to credits. So It is the last step in the accounting cycle. Also it determines if there are any balances in the permanent accounts after passing the closing entries.

The word post in this instance means after. A listing of all permanent accounts and their balances after closing. In preparing a post closing trial balance which are the correct statements - the capital account on the post closing trial balance will include the net income or net loss for the period - all permanent accounts with a balance in the general ledger will be included - the total of all debit balances will equal the total of all credit balances.

The post-closing trial balance is used to verify that the total of all debit balances equals the total of all credit balances which should net to zero. What is the post closing trial balance. A post-closing trial balance is as the term suggests prepared after closing entries are recorded and posted.

Since closing entries close all temporary ledger accounts the post-closing trial balance consists of only. A post-closing trial balance is a list of balance sheet accounts with non-zero balances at the end of the reporting period. The aim is to have the two figures equal each other for a net zero balance.

It is the third and last trial balance prepared in the accounting cycle. The post-closing trial balance also known as after-closing trial balance is the last step of accounting cycle and is prepared after making and posting all necessary closing entries to relevant ledger accounts. The balance verifies that the debit balance equals the credit balance.

Prepare A Post Closing Trial Balance Principles Of Accounting Volume 1 Financial Accounting

The Post Closing Trial Balance Open Textbooks For Hong Kong

I V Your Answer Is Correct Match The Item On The Left Wlth The Definition On The Rtght Pdf Free Download

Comments

Post a Comment